- Pursue United states

- Click to express toward WhatsApp (Reveals during the new screen)

To order a property comes to a ton of money. Very, few individuals have the ability to buy one outright playing with her loans, because most of somebody need to use away a property loan to find their dream home.

As the home financing will bring funding to buy a long-title asset, facilitates saving rents from the thinking of moving home and also brings tax pros towards focus commission and you may dominating installment, individuals likely to get their unique family love to avail the fresh loan.

To find a house is just one of the top financial requirements for many of us. Although not, by the large price of a residential property, it gets tricky for all those to invest in a house out of their unique wallet. Thus, a mortgage are an useful choice for people in order to buy the most readily useful house. However, taking out a mortgage necessitates big move throughout the investing option to afford the EMI. This means that, our home mortgage are affordable and right for your. This is where a home loan EMI calculator gets in the newest visualize to help you work out how far EMI you’d provides to pay monthly to settle the loan for the a certain amount of time, told you Pramod Kathuria, Inventor & President, Easiloan.

These are just what home financing EMI calculator does, Kathuria told you, Your house Loan EMI Calculator was an internet product that will help one to estimate their monthly mortgage EMI. The user-amicable style of the net calculator systems enables you to easily toggle amongst the chosen interest rate, amount borrowed, and you can loan tenure, that delivers certain payment solutions centered on your decision.

It can help you select best financial plus the best financing number

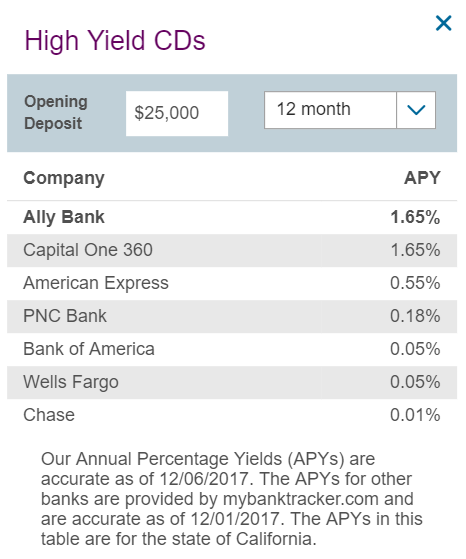

With lots of loan providers offering effortless lenders, it becomes difficult to select the right that. In this situation, you are able to the fresh new EMI calculator so you can analyse the total pricing of various loans and determine which supplies value for your money.

Likewise, you should always get an amount borrowed that one can easily pay instead putting after that strain on your bank account. And therefore, you are able to our home financing EMI calculator to track down an excellent most readily useful thought of just how much financial number you can afford. This will make payment easier and reduce the probability of default.

It will help you choose the suitable period

Brand new tenure of mortgage is vital inside the choosing the fresh new monthly instalment matter. Your property loan EMI would-be smaller if you have a great longer tenure, whereas a shorter term would end up in a more impressive EMI. Thus, see financing term that renders their EMIs in balance according to your income and you can using. You can find the ideal tenure on EMI calculator.

They simplifies planning prepayment of your own mortgage

With a thought about the asked EMI helps make planning the fresh financial prepayment simple. This can decrease your desire commission and you may hasten brand new repayment regarding the debt. Particularly, when you find yourself aware of your own EMI, it’s also possible to without difficulty strategy part-prepayments and you will bundle the brand new time of the assets.

It’s not hard to have fun with

There are not any difficult data doing work in playing with a home loan calculator. All you loans in West Point have to do try go into the prominent matter, interest, and you will mortgage title, plus in a couple of seconds, accurate formula of the EMI will look on your pc screen.

The home online calculator the most valuable devices, that makes the process of choosing and you may paying down a home loan simple and easy much easier. Therefore, calculate your residence mortgage EMI and have home financing now to buy the house you dream about. not, do your research to your financial before applying to have a house financing to cease any inconveniences later, told you Kathuria.