A couple of essential pieces of recommendations on borrowing statement try your credit score plus credit score.

A credit history was a rating the financing agency offers you because the a borrower. It range from three hundred to 850 and are usually determined with situations including your percentage history, the debts, and length of credit rating. Your credit history procedures how long you have got addressed some lines off borrowing from the bank. The percentage history tracks though your missed any money during those times.

Most lenders wanted at least score of 600 to help you qualify for that loan. Into the 2020, a great BankRate questionnaire shown 21% from U.S. people had a credit card applicatoin refused due to a reduced borrowing from the bank rating. Although not, certain loan providers offer alot more versatile criteria getting borrowers that have poor credit. Like, BrightUp now offers caring money in the form of an emergency Loan. This one doesn’t have at least credit rating criteria. We supply a debt consolidation and Refinance program that uses solution underwriting to grow the means to access sensible cost. When you find yourself poor credit lenders are more difficult to acquire, they actually do can be found.

2. Money

Ahead of recognizing the application, a loan provider must end up being certain that you really have adequate constant money to settle your loan. Even though you have a good credit score, you will be less inclined to become approved when you’re around efforts or are asking for additional money than you can afford to help you repay. Minimal earnings standards to acquire a consumer loan vary from the bank by amount borrowed.

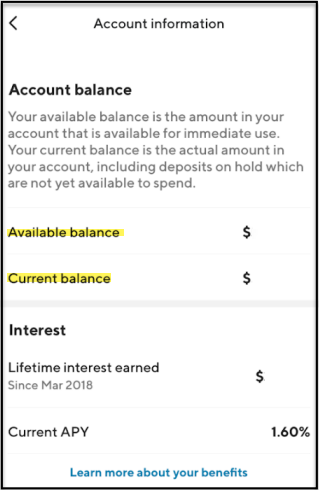

You can show your income with latest tax returns, lender comments, spend stubs, otherwise a finalized page from the company. If you’re mind-employed, you’ll be required to promote your own tax statements and you will financial deposits.

step three. Debt-to-Money Ratio

Even if you have a great credit rating and you will a healthy and balanced income, lenders wouldn’t always deal with the loan. Eg, suppose you currently started high expense. In that case, there could be certain fear of your capability making any extra repayments monthly. Your debt-to-money ratio ‘s the percentage of the monthly earnings that’s already appointed given that payment having pre-existing debts.

If you are lenders may have other loans-to-money proportion requirements, you’re in this new safer area when your ratio was thirty-six% or less.

4. Guarantee

Don’t assume all unsecured loan need guarantee, many borrowers may prefer to power guarantee when making an application for financing. If you would like get a secured personal bank loan, you’ll be needed to vow rewarding assets equity-including, your vehicle, home, otherwise savings account. Equity handles the financial institution for many who get behind on your money or default on your mortgage. The lender have a tendency to repossess the brand new guarantee to purchase leftover balance on your own mortgage.

Regarding the Loan application

Requirements for a financial loan may differ out of financial to help you financial. Particular loan providers are willing to work on individuals having straight down credit results. Conversely, other people have lowest standards one to shut of numerous borrowers aside. Yet not, the loan software and you may feedback procedure is comparable for the majority of loan providers.

To prove their creditworthiness according to research by the considerations significantly more than, make an effort to promote higher-peak personal information and you may authoritative paperwork.

Proof of Identity

In order to qualify for that loan, you ought to prove that you is located at the very least 18 decades old and you will a citizen of the All of us.That is one of the first traces from protection from label thieves when you look at the lending. Examples of appropriate kinds of character tend to be:

- License

- State-granted ID

- Passport

- Beginning Certificate

- Military ID

- Certification from citizenship

Proof Target

Like borrowing unions and you can community banking institutions, particular loan providers wanted one individuals live in this a designated services footprint. For others, needed your local area recommendations to enable them to mail one bills otherwise papers to you. You can render proof target with a bit of mail, a current utility bill, your rental arrangement, or good voter subscription card.