On top of that, it is important to look at the affordability and you will sustainability regarding a tiny domestic. As they have a lower life expectancy purchase price versus conventional land, you need to however cautiously take a look at your budget and ensure you can also be comfortably pay the monthly mortgage repayments or mortgage installment payments. Moreover, you should also consider the much time-name https://paydayloansconnecticut.com/pemberwick/ costs associated with fix, resources, and you will insurance rates.

Financing Limits and you will Terms

In terms of to purchase a small household using a good Veteran’s Issues (VA) mortgage, its vital to see the mortgage restrictions and you will terms and conditions in the these types of resource. Below are a few essential facts to consider:

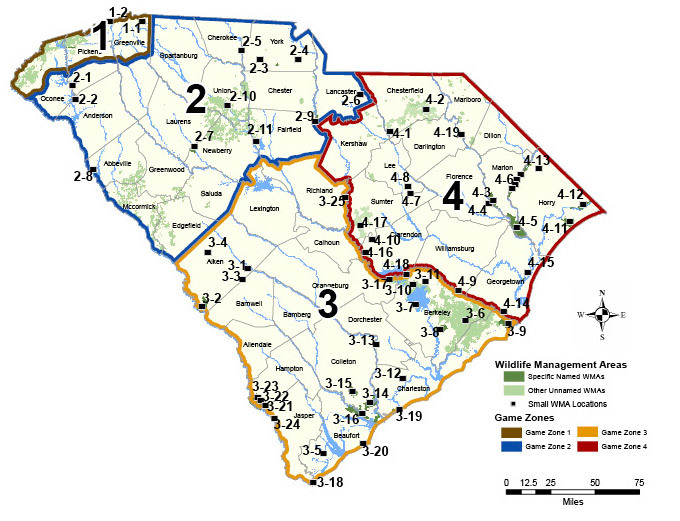

- Financing Limitations: This new Va possess specific financing limitations one to dictate the most you can use. This type of limitations will vary based on the county where house is receive. It’s necessary to look at the newest financing limits towards you to be sure your own lightweight family drops during the recognized range.

- Loan Conditions: Virtual assistant loans offer positive terminology to veterans, and aggressive rates of interest and versatile installment choices. The loan terms generally speaking range between 15 to 30 years, enabling you to choose a payment package that aligns with your financial needs.

- Most Will set you back: As Va loan covers the price of the little house, you will need to account for most expenses like closing costs, insurance policies, and taxation. Be sure to cover such can cost you to prevent one shocks inside real estate procedure.

Understanding the loan limitations and you will terms of a great Virtual assistant financing are necessary to make certain a smooth and you will effective purchase of your small family. By familiarizing oneself with your information, you may make told decisions and you will keep the money you prefer to show your smaller home aspirations towards reality.

Shopping for a loan provider

You’ll find a lender for an excellent Veteran’s Activities (VA) financing to find a small home by evaluating and you can contacting accepted Va loan providers close by. With regards to wanting lenders to possess good Virtual assistant financing, you will need to choose one which is knowledgeable about this criteria and you can advantages of the fresh Virtual assistant mortgage system. Because of the dealing with a medication Va financial, you can guarantee that you will have access to the mortgage possibilities that are available to you due to the fact a seasoned.

First off your pursuit to possess a lender, you can visit the state website of your You.S. Institution of Pros Factors. They give a listing of approved Va lenders that you could get in touch with to learn more. Likewise, you can get in touch with regional finance companies and you can credit unions to help you inquire about the Va loan software. It is vital to find out about its experience in Virtual assistant funds and the comprehension of exclusive areas of to find a little home.

When contacting loan providers, make sure you find out about the mortgage solutions they offer for to invest in a tiny family. Specific loan providers have certain conditions otherwise constraints with regards to in order to financial support a little home. It is vital to see a loan provider exactly who knows the initial character off tiny home financing and can give you the better financing options for your circumstances.

Obtaining good Virtual assistant Loan

To apply for a good Va loan, it’s important to assemble most of the called for records and you will talk with a prescription financial who’ll guide you from app techniques. Here are the strategies you ought to try guarantee a delicate and effective Va mortgage procedure:

- Gather the required paperwork: Just before interviewing a lender, definitely have the needed papers ready. This normally includes proof money, financial statements, taxation statements, and your Certificate of Qualifications (COE). Having these documents prepared will assist expedite the application process.