- Personal

- Savings

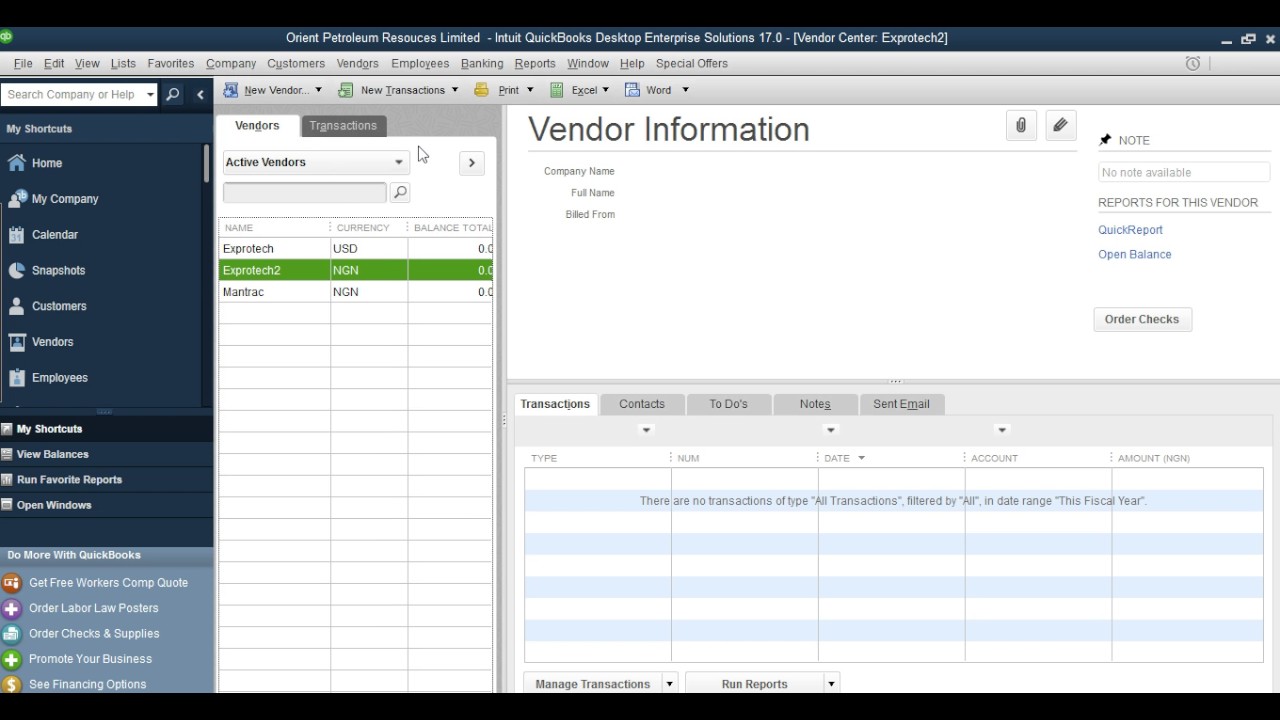

- Currency Field

- Retirement Profile

- Licenses out-of Put

Household Guarantee Products which Number

Are you presently a resident trying to find currency for a job? A house guarantee financing could be the finest financial provider having your. Read the publication below and discover all you have to know about household equity funds and current costs, and just how much you are capable use.

What is a home Equity Financing?

While the a citizen, you can access good economic investment which are often used in problems, debt quality otherwise money an event: the newest security you currently have of your house.

Which loan, also known as an effective second financial , is a type of money alternative enabling one to obtain as much as this new dollars difference in your own house’s current market value therefore the balance due on your mortgage. The quantity you are allowed to acquire will require on the account earliest mortgages and just about every other personal debt currently secured by your household.

How much cash Do i need to Obtain?

A home collateral financing is a great solution when you are trying to find a lump sum of money to invest in a keen costs. It is different from property-guarantee line of credit (HELOC), which allows one access a loan within the sometime-by-section method.

Inside the determining how much money you ought to obtain, believe the money could be loans in Selma made use of and exactly what payment per month you can afford and make consistently. Family security finance are ideal for a large amount of currency which can be paid down monthly in this a fairly quick timeline. For example expenses, matrimony expenditures, a large-citation get such as for instance an auto otherwise do it yourself.

Mortgage So you’re able to Worth Proportion

So you can take a look at exactly how much you are capable use, you ought to earliest comprehend the mortgage to help you worth ratio. Lenders normally only offer financing quantity one change towards differences between a share away from most recent well worth and you may financial balance in the finance, therefore the percentage of the house’s readily available worthy of is called its loan-to-really worth (LTV) proportion.

Just like the a good example, assuming that a loan provider was happy to give 75% of your property really worth, that is currently $200,one hundred thousand, as well as the mortgage owed was $a hundred,100000. The maximum home security financing might be $fifty,100000 (i.elizabeth. $150,one hundred thousand – $one hundred,000). You could potentially determine the correct total acquire immediately after learning new maximum a loan provider instance F&M Lender NC could possibly offer, plus figuring full expenditures for the enterprise.

You could potentially score a house security loan for the Northern Carolina from the brand-new mortgage lender. Although not, this is simply not necessary that you utilize them for this solution. Based on the connection with the financial institution, although not, recite patronage you’ll allow you to get a much better contract.

Since the a customer, you’re able to look around for the best terms and conditions. If you aren’t proud of your new home loan lender’s bring, think additional options, as well. Keep in mind that a beneficial bank’s LTV ratio and you can rates will likely be among the many key factors to make your decision.

Your credit score

When examining your house equity loan application, your prospective financial commonly comment your borrowing from the bank percentage history and you may score. Borrowers with a credit score of at least 620 or even more and you may an excellent financial obligation-to-money (DTI) ratio are a lot prone to end up being approved.

Have there been Restrictions about how Money Should be Spent?

There are usually couples restrictions regarding how make use of the cash made available to your. Yet not, it’s best, financially, discover home financing to suit your most significant costs just.

What’s the Newest Rate and Where Should i Tune Price Increases otherwise Minimizes?

Domestic collateral funds typically have a predetermined rate of interest and require which you pay a fixed matter monthly having an assented stage. not, there are even loans which have varying costs dependent on markets conditions.

Already, interest rates to the 15-seasons home equity finance inside Vermont are priced between cuatro.25% to 8.11%, to your mediocre price being 5.97%. Mediocre rates of interest on the ten-12 months and you will 5-year house security finance on state is actually 5.72% and you will 5.57% correspondingly.

It is best to inquire about rates from your popular lender, once the creditors can use different factors to decide pricing and you will/otherwise offer speed savings.

Work with An educated Financial From inside the NC

Are you aware that we had been in fact Chosen brand new Ideal Lender during the Cabarrus and you can Rowan areas by the the customers? You want to help you discover all the solutions to help you your.