Not too long ago he is already been popping up A lot inside my Twitter stream driving his applying for grants mortgage loans, owning a home and credit

Dave Ramsey is actually people the majority of people go after having financial indicates. Some of their records, I don’t completely disagree which have. In reality, We shared a blog post you to came from his category guaranteeing some one to keep to pay rent to make its home loan repayments throughout the new pandemic ideally (ie nothing is free-of-charge). Yet not, Really don’t service what the guy will teach their supporters who’re given to order a property and i also enjoys an issue with someone just who forces the team regarding vetted real estate professionals…I might be very amazed if there’s not some type away from monetary matchmaking associated with this recommendation arrangement.

Why don’t we consider exactly what the guy encourages his supporters so you’re able to would with regards to to get a property otherwise bringing a mortgage.

DR: Your full mortgage repayment is to just be twenty five% of your own take-home pay. The mortgage repayment is sold with the primary and you will attract, assets taxes, home owners insurance rates and maybe home loan insurance. Your own get hold of shell out can be your online-income shortly after taxation, insurance coverage, 401(k) or other deductions you have. Advice to possess mortgage loans as to what part of money is acceptance to be used with the mortgages and all sorts of most other debts (aka personal debt-to-earnings percentages) will vary dramatically according to borrowing from the bank reputation, amount of collateral or down payment with the home too because the newest lending ecosystem. I do choose that individuals are not family terrible because of the biting out of a bigger mortgage repayment even though they meet the requirements towards commission according to research by the latest financing direction, yet not 25% of one’s web-income is quite restrictive, particularly with my 2nd section…

The fresh 15 seasons financial generally speaking has the benefit of a somewhat better rate of interest (about 0

DR: You will want to just use an effective 15 12 months amortized home loan. 25%) as compared to a lot more popular 29 season amortized financial. Even with it improvement in rate of interest, the mortgage fee is much more than the 29 year home loan once the term are cut-in 50 % of. The fresh new 30 seasons financial offers alot more flexibility by permitting you to really make the most dominating money (once i simply referenced) or perhaps the additional month-to-month funds can be utilized toward paying off other debts otherwise building your retirement While you are own an effective household that you’re strengthening security within the. While doing so, if you possess the 31 12 months and you also end needing particular push-room on account of an economic crisis, there is the quicker 31 season commission vs are caught with the higher 15 seasons homeloan payment.

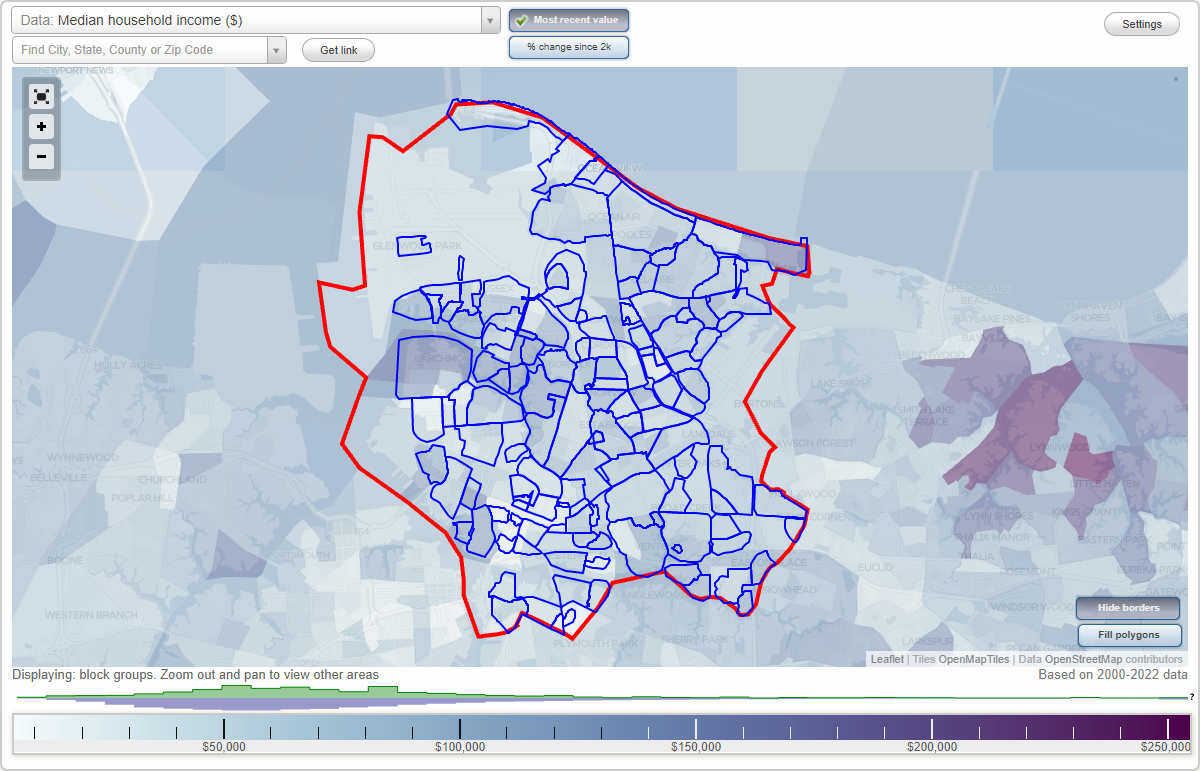

DR: You have a beneficial 20% downpayment prior to purchasing a house. online payday loan Virginia With a good 20% downpayment makes you stop personal mortgage insurance that have an excellent traditional mortgage. It will not avoid mortgage insurance coverage for folks who wanted a keen FHA home loan. USDA and you may Virtual assistant mortgage loans don’t possess month-to-month home loan insurance rates, however there can be a single go out resource fee. I am whenever he’s referencing a normal home loan and you will with respect to the credit rating, down-payment and you may program, the mortgage insurance coverage ount Along with a conventional financial, the latest month-to-month private home loan insurance coverage (referred to as pmi) instantly falls out-of in the event the amount borrowed are at 78% of your own worth of the home predicated on in the event that insurance rates are obtained (well worth = the fresh reduced of your own appraised well worth or conversion process rates). The biggest reason not to loose time waiting for acquiring the 20% deposit before you could think to purchase a property is that the housing market will away rate your coupons otherwise resource account. Home prices were growing considerably within the last long-time. The house you could buy now which have 5 otherwise 10 percent down payment will rates significantly more by the point you have got 20% off (and additionally closure cost and you will supplies) secured. Discover a payment from wishing from the postponing your residence purchase to store up the large deposit.

I think it is so important to keeps a spending plan and you can know simply how much you can afford getting a monthly payment. Just because you could qualify for a mega-mortgage repayment does not always mean that you should. This may be also quite expensive in the long run to to try to hold back until everything is financially primary (web browser your be eligible for fifteen 12 months home loan with 20% downpayment that have a mortgage that is merely twenty five% of your net income).

Follow this link to have a follow up post where We show instances from Dave’s theories on mortgages and in case accompanied, the way it influences what one can possibly get having a house.