Approximately 65% away from American households individual her household as of 2022, with regards to the You.S. Census Bureau. For the past a decade, the new average profit price of a home in the united states has actually grown out-of slightly below $240,one hundred thousand for the 2012 to help you nearly $430,one hundred thousand into the 2022, getting a good 10-season improve from almost 80%. Inside white regarding the, many people have experienced the fresh equity bad credit loans in Sacramento in their home grow somewhat because they bought it.

Having positive collateral of your property brings residents the flexibility to help you pull that riches in several ways. One method to possess being able to access so it security will be to pay-off area otherwise your financial by using a home security mortgage. On this page, we will take a look at the advantages and you will cons associated with means.

Secret Takeaways

- Property security financing enables you to borrow up to a beneficial specific portion of your house security.

- Your home is guarantee on the mortgage, which allows the rate as far lower than just good bank card or unsecured line of credit.

- Specific people sign up for this type of money to settle their mortgage loans, as it can certainly potentially bring about down financial support can cost you. But there are also risks involved.

step one. Domestic Collateral Financing (Next Mortgage loans)

The first is by using a traditional domestic guarantee mortgage, which is both also known as an additional mortgage. These types of financing is largely exactly like a mortgage financing, except that unlike heading into the purchase of property, it leads to this new debtor getting a lump sum payment of cash that they are absolve to spend nonetheless focus.

The particular sized this lump sum payment is actually calculated while the a portion of the newest collateral they’ve in their home, that have 85% are a commonly used limit. Like, if the a homeowner enjoys a mortgage to possess $200,one hundred thousand however their home is value $3 hundred,100000, after that its collateral will be $100,100. In the event that their property collateral mortgage also offers a lump sum payment off up so you can 85% of its equity, then they could borrow up to $85,one hundred thousand. Even though some homeowners use these financing to spend off the home loan, they could also pull out a home security financing to cover almost every other costs, particularly renovations their kitchen area otherwise purchasing school.

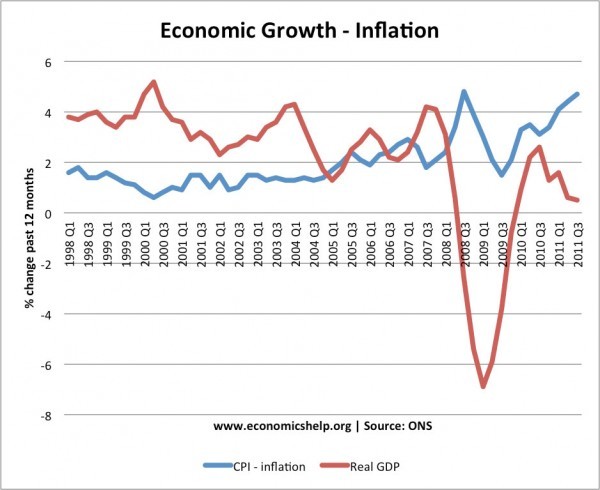

Precisely why home owners sign up for domestic equity fund in order to lower the financial is because they thought doing so tend to cause straight down monthly installments. This can occur when rates of interest have declined because they earliest ordered their house, therefore the household guarantee financing carry out hold a reduced attract price than the present financial. Within this circumstance, the newest citizen do sign up for property guarantee loan, which could enjoys a unique rate of interest, amortization schedule, and you will name, and you may basically might possibly be refinancing some otherwise each of their current mortgage.

No matter if using a property guarantee loan in order to re-finance their mortgage normally produce lower attention will cost you, homeowners must be careful in order for which economy isnt annihilated by people prepayment penalties otherwise closing costs which may implement. With regards to the specifics of their existing mortgage terminology, it can be more beneficial to only wait until next available possibility or refinance the financial, by way of both its established lender otherwise a fighting lender.

dos. Home Collateral Personal lines of credit (HELOCs)

Another method in which people are able to use their home guarantee so you can pay down its mortgage is via taking out fully a house collateral line of credit (HELOC). As its term implies, HELOCs is a line of credit which is secure by the house. Such as for instance the next mortgage, what kind of cash as possible obtain around a good HELOC was calculated by using a share of your home collateral, typically the same as that which can be used having next mortgage loans. However, aside from these similarities, you will find several very important differences when considering HELOCs and you may 2nd mortgage loans.