This standards to try to get a home collateral loan varies anywhere between loan providers, but the majority lenders impose a few of the pursuing the conditions:

- The debtor is to own no less than fifteen% so you’re able to 20% of the house getting experienced the ideal applicant getting a family security mortgage.

- The fresh new joint loan-to-value ratio of the house should not go beyond 80%.

- The borrower’s debt-to-money proportion are going to be less than 43%.

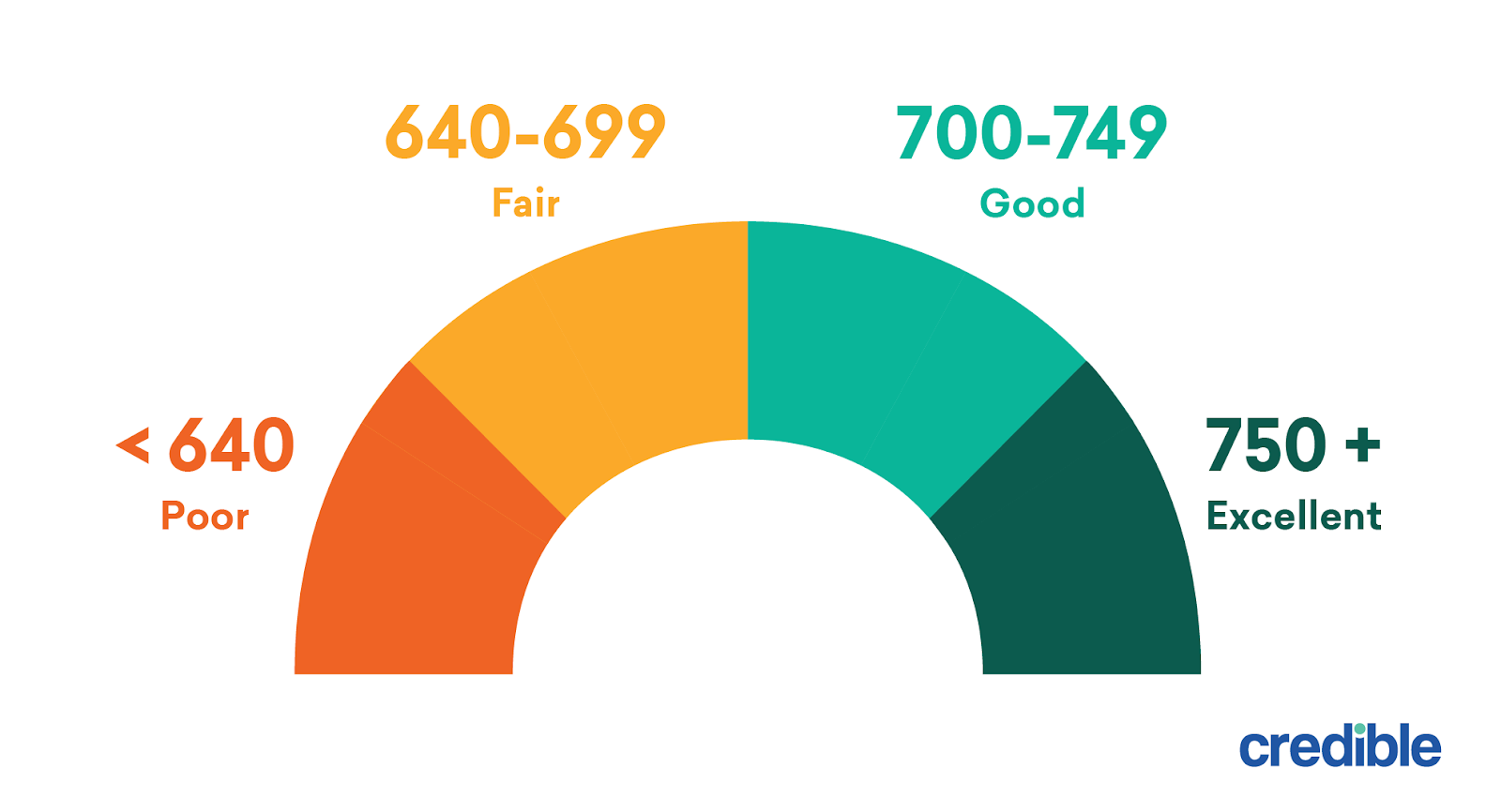

- At least credit score out of 620 is sometimes required.

- The property that will be made use of as collateral needs to be appraised because of the a third party that’s recognized or designated from the the lending company.

Fees off Domestic Security Funds

Home security loans was provided due to the fact a lump sum, and additionally they can be used for certain intentions. Such loans was paid off because of a couple of payments that usually extend out-of ten to twenty five years.

For each and every cost consists of part of the loan’s a fantastic balance and a destination costs repaid for the financial because the compensation getting facilitating money. Due to the fact for each and every cost is paid off, the latest homeowner progressively recoups part of the home’s guarantee.

Just before 2017, the eye charges paid off towards the household guarantee fund had been fully deductible out of another person’s taxes. This increased new popularity of such money because they was a great inexpensive alternative to other types of individual fund.

Nevertheless, the Income tax Cuts and you may Employment Serves out-of 2017 eliminated the option out-of deducting the eye paid on these funds with the exception of items where funds are widely used to pick, build, or boost the taxpayer’s home.

Which amendment reduced the newest beauty of domestic collateral fund, as they continue to be a stylish option due to the all the way down interest energized to the house security finance as compared to individual financing.

Foreclosures down to Defaulted House Guarantee Finance

Once the property equity mortgage work because the a home loan, the underlying possessions serves as equity if your debtor does not meet the obligations https://paydayloancolorado.net/fort-morgan/. Thus loan providers have the right to foreclose into the domestic, while they can decide to not ever not as much as specific products.

Instance, if your worth of the loan is much lower than this new value of the house or property, the financial institution will in all probability choose to foreclose to your household. There can be a leading chance that they will see enough funds from selling the house or property to fund to the a great equilibrium of obligations.

On top of that, should your worth of the house keeps rejected and that is now below new a great equilibrium of the loans, the lending company get choose not to ever foreclose the home because it will in all probability bring about a monetary losses. Still, the financial institution you can expect to still document a legal allege up against the debtor, that could eventually affect the borrowing situation.

Domestic Security Money & Credit ratings

A borrower’s fee record on the a house security loan may affect their credit history. These types of money is addressed because a regular borrowing from the bank account, and you can any late repayments often adversely impression a person’s borrowing disease.

Domestic Collateral Money against. House Collateral Lines of credit (HELOCs)

House security personal lines of credit (HELOCs) also are believed the second home loan, nonetheless they performs differently than domestic equity fund because they are revolving borrowing accounts. As a result as opposed to a lump sum payment, HELOCs let the debtor so you can withdraw funds from the credit membership and you can pay off the balance any kind of time given section during the draw period.

- Way to obtain the amount of money: A house collateral loan constantly contains the debtor which have a swelling contribution percentage for your number of the borrowed funds, if you find yourself good HELOC properties similarly to credit cards. The fresh debtor usually takes currency from the line of credit during the one area into the draw months and you will pay it off as they excite. Given that draw months ends up, not any longer withdrawals can be produced, and the borrower need to pay right back the fresh new loan’s dominant, also the focus fees applicable inside installment stage.